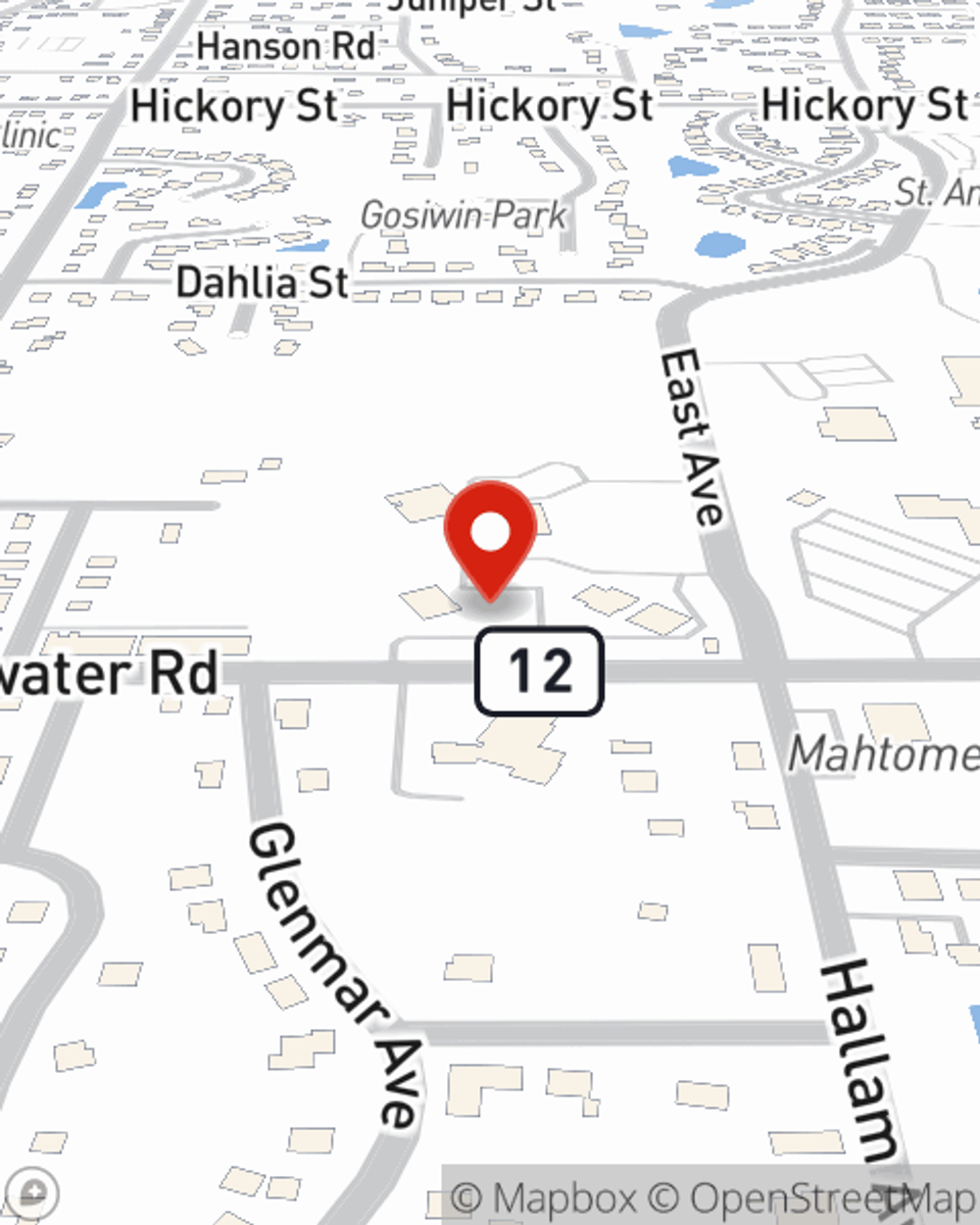

Business Insurance in and around Saint Paul

Calling all small business owners of Saint Paul!

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, business continuity plans and a surety or fidelity bond, you can rest assured that your small business is properly protected.

Calling all small business owners of Saint Paul!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a book store, a dance school, or an appliance store, having the right coverage for you is important. As a business owner, as well, State Farm agent Sarah DeBruin understands and is happy to offer personalized insurance options to fit your needs.

Agent Sarah DeBruin is here to consider your business insurance options with you. Call or email Sarah DeBruin today!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Sarah DeBruin

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.